Plans are the ways to make reality. We all imagine about the life we want to live, and work our efforts around it. Planning money around your efforts make it easy to see the cashflows and make the dreams under the zone of afforadability.

So this takes us to plan our cash flows. Planning cash flows for the personal life are the stepping stones to understand personal finance. Planned cash flows converted into the form of milestones are personal finance goals.

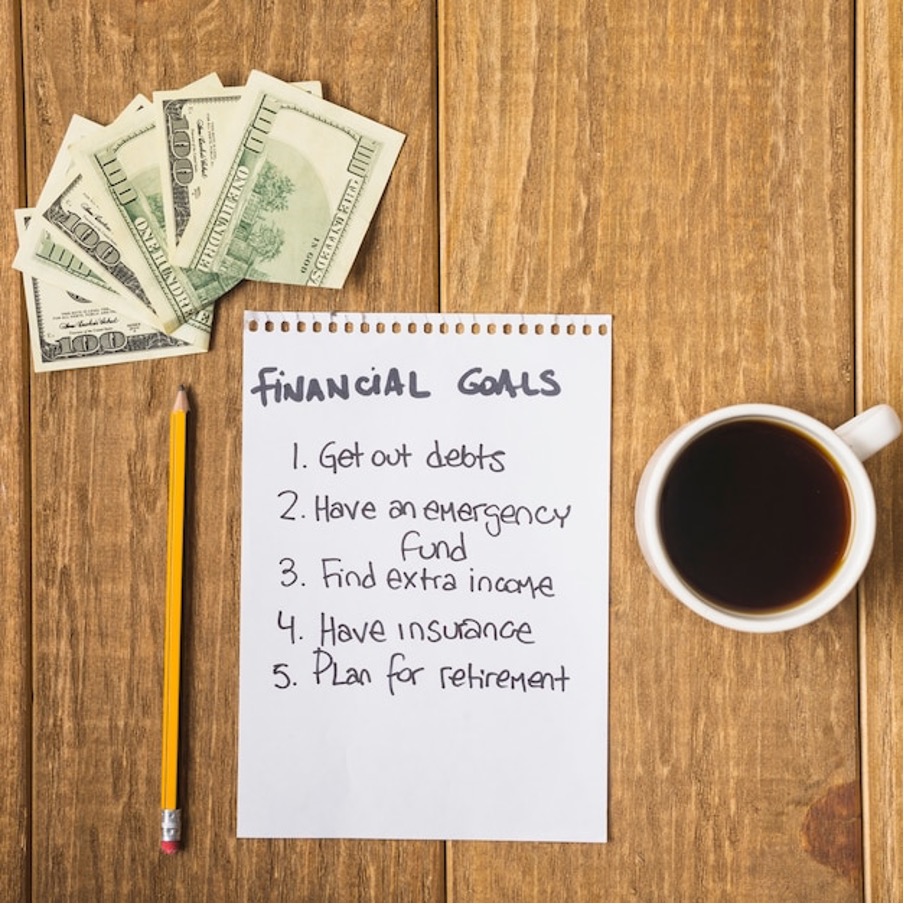

Personal finance goals, thus, set the ground work to understand effective ways to spend and save money. It involves both work and personal life aspects. These are the goals which a person wants to achieve their money in future. These goals may vary from person to person and may change over the course of person’s lifetime. Considering the long term perspective of life, personal financial goals can be anything that lead to better life style, reduced levels of debt, and better plan for a relaxed and comfortable retirement.

Thus, personal finance goals are economic milestones which aspire a person to improve upon their existing financial situation, achieve financial dreams and ultimately achieve financial security, freedom and dream financial status.

What are my personal financial goals?

Personal financial goals vary from person to person. Such goals depend upon the a number of factors like age, current income levels, desired set of assets, ambitions in life, existing levels of debt, different sources of cashflows, spending habits, retirement plans, responsibilities etc.

Personal finance goals must touch key points of your life like required amount of emergency fund, debt, investments, key assets, major expenses (like children college admission, marriage, any medical contingency), retirements etc.

So, personal finance goals lie on a wide range of continuum. Broadly, personal finance goals can bucketed as short run personal finance goals, medium run personal finance goals and long run personal finance goals.

How do I define my personal finance goals?

Defining the personal finance goals involves identifying specific objectives, setting realistic deadlines and dreaming resources needed to achieve them.

Defining your personal finance goals is like designing a fine blueprint for the your dream life.

The first step is to define precisely your long-term personal finance goals, then splitting those long-term goals into small-term personal finance goals. This makes you to think deeply on it to list and prioritize financial goals.

Secondly, nothing can replace the basics of finance. You must work to attain basic understanding of basic concepts like compounding, inflation, saving, emergency fund etc. Understanding this would enable you to chalk out your personal finance goals based on firm finance basics.

Third, connect each personal finance goal to a deeper motivation. As you review your goals, you must reflect on the purpose behind each of these. You must answer the questions like “Who is the goal going to benefit? Why am I pursuing this? What is underlying motivation for the goals?”. Understanding the “why” behind the personal finance decision and goals helps you to be more committed and help you to understand how the goals get associated with other goals.

Fourth, make a financial plan in order to achieve and reach your personal finance goals in time. You must understand that the goals work together when they are part of a master plan. Work yourself or take help from finance professionals in order to understand how you are going to position yourself to achieve your goals. Timeliness should be one of the driving factor.

Lastly, you must revisit your financial goals regularly. You must decide the points when you would reflect on your journey towards achieving personal finance goals.

Plans are the ways to make reality. We all imagine about the life we want to live, and work our efforts around it. Planning money around your efforts make it easy to see the cashflows and make the dreams under the zone of afforadability.

So this takes us to plan our cash flows. Planning cash flows for the personal life are the stepping stones to understand personal finance. Planned cash flows converted into the form of milestones are personal finance goals.

Personal finance goals, thus, set the ground work to understand effective ways to spend and save money. It involves both work and personal life aspects. These are the goals which a person wants to achieve their money in future. These goals may vary from person to person and may change over the course of person’s lifetime. Considering the long term perspective of life, personal financial goals can be anything that lead to better life style, reduced levels of debt, and better plan for a relaxed and comfortable retirement.

Thus, personal finance goals are economic milestones which aspire a person to improve upon their existing financial situation, achieve financial dreams and ultimately achieve financial security, freedom and dream financial status.

How can I get near achieving my financial goals?

Staying motivated and challenged is crucial for achieving personal finance goals. You can follow the following tips to include in achieving your personal finance goals.

- Challenge yourself to stick to the plan and budgets. You must divide your personal finance goals into smaller budgets, and then review your actions against the plans.

- Challenge yourself to participate in no-spend zone. This will help you to save money to contribute to your financial goals. This will help to foster the mindset encouraging conscious spending and prioritizing necessities over luxuries.

- Educate yourself finances and this will empower you to take decisions in a more informed way and save more effectively. Understanding key financial terms will help you to understand money management in a better way and take informed decisions.

- Adopt minimalist lifestyle. Living on minimal requirements, allows you to save money and can be redirected towards achieving your financial goals.

- Implementing cash only budget can reduce spending as handing over physical cash makes you more conscious of your purchases. This approach helps redirecting savings towards financial goals.

- Setting a fixed budget for tasks helps to identify essential purchases and seek discounts effectively.

- Rewrite money script to transform relationship with finance. Focusing on relationship with finances. This will focus on positives and gratitude in fostering stronger motivation to achieve financial objectives.

- Keeping consumerism journal enhances awareness of spending habits. This allows for adjustments in financial behavior, ensuring alignment with personal values and long term goals.

- Utilize existing resources at home to help save money and reduce unnecessary spending. Find time for personal reflection and planning which is crucial to achieve financial goals. Carving out an hour daily allows for budget reviews and personal growth.

Leave a Reply