Since ages Gold has been respected as an asset. The respect that gold has earned is not because of the returns it has generated for those who have held it over a long period of time, but for its capacity to act as a hedge against the wars, economic crises, recessions and market uncertainities.

However, the reasons for holding gold over centuries have also evolved with the evolution of societies and markets. Still the respect of gold as an asset is intact.

Gold is just a metal, yet the craze for the acquisition of this metal has neither faded nor tarnished. One of the primitive reasons for respecting gold was its use in currency coins. Gold is a noble metal, that means it is free from the risk of corrosion over time. Its value won’t deplete with the passage of time. Making the choice of gold in currency coins made it stand out from the rest of the metals, and made gold equalivent to currency. Over decades, this wisdom has made gold as a metal of choice.

In this article, we would be discussing why do people invest in gold?

Gold has captivated humanity for millennia. Beyond the aesthetic beauty, gold has emerged as an asset which has been uniquely placed in the financial world for ages.

In this world moving towards cryptocurrencies and other complex investment vehicles, gold has not lost its luster of being an invaluable asset class. What makes gold emerge as an asset? The prime answer to this question is that gold is an asset because it acts as a store of value, hedge against inflation and a safe haven. With the prices of gold soaring to new highs, it’s important to understand why you should invest in gold.

Gold is a storage of value : When we see gold as a store of value, it implies that it acts as a hedge against inflation. Inflation leads to erosion of purchasing power, and loss in the value of the currency. In other words, inflation makes money purchase lesser commodities than it used to do. Historically, gold as a precious metal has proved that it has provided cushion against inflationary pressures. Gold has a long trailing history of maintaining its value in comparison to inflation. While the price of gold fluctuates in the short term, historically, it has shown a positive correlation with inflation.

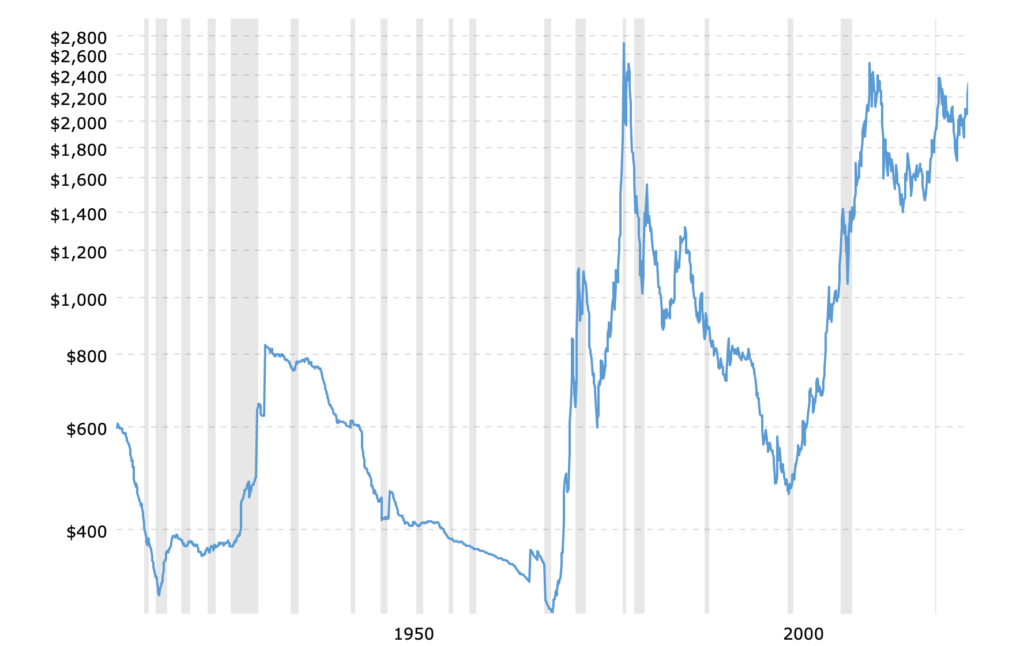

The above chart is historical chart for the inflation adjusted prices for gold. Dark shaded lines indicate the recessions world has witnessed. It takes no brainer to understand that gold has proven to hold value over time.

Gold is money: Gold is neither a currency nor does it earn any interest. Trading gold for other commodities would make us end up in barter system, then the question arises : How is gold money?. The factgold is considered money comes from its ability to store value and liquidity it holds.

Also, history holds episodes when governments have tried to hold the value of money against the precious metal, gold. History suggests that gold has been used to exchange value is longer thatn that of British Pound Sterling. Gold has established itself as currency coins in ancient times even before the today’s monetary system. For instance, the time period 1870- 1914 has been marked as ‘The Classical Gold Standard’ where major economies like Great Britain, Germany and the United States pegged their currencies against the weight gold. Gold became foundation for stable exchange rate system. Though the system did not continue for long, but it established the understanding that countries with gold backed currencies can feel free.

Again during 1920s-1930s, after the disruptions of World War I, many countries attempted to restablish gold standard. Similarly, 1944-1971 again called for gold and US dollar became the world’s reserve currency, which was pegged to a fixed price of gold at $35 per ounce.

Gold’s legacy as a base for currencies and strong foundation for the monetary system during tough times made it to be perceived as a form of currency.

Gold is safe haven : Gold as a hedging instrument has been viewed from the lens of safe haven as well. An asset is said to be a safe haven when it is uncorrelated with another asset or portfolio in times of market stress or turmoil. Investors have observed gold as “flight-to-safety assets” phenomenon during the crisis.

Comparing the returns with other assets, especially equity market instruments, gold has performed well when the returns from equities decline. This property of holding low or negative correlation with stock market returns makes gold to be known as a safe haven. Gold tends to hold its value in ‘stormy weather’ or ‘adverse market conditions’.

Gold is considered a resilient investment. Comparing it with returns from debt markets, gold has proved its worth as a safe haven during times of economic and international turmoil. Even during the times of political uncertainty, gold has maintained its store of value. When central banks lower the interest rate, then precious metals like Gold become more attractive.

Owing to negative correlation gold has kept with market returns during tough times, gold becomes a good option for getting included in a diversified portfolio. We can say that gold brings a balancing effect in the portfolio and makes it more diversified. This allows investors to lower overall portfolio risk. Additionally, gold protects investors against the market volatility and provides stability during the times of market corrections. Investments in gold has never turned anyone bankrupt

Gold is a liquid asset: There are many other precious metals, still gold tops all the others as an investment choice. Making gold as a preferred choice of investors against other precious metals is the liquidity, trust and global acceptance it brings on table. Gold is considered as a highly liquid asset. It can be easily purchased and sold through well established, trusted and followed channels. Small and local markets of an economy/country offer ready liquidity making gold as one of the liquid assets. Even during the tough times, gold didn’t tend to lose the liquidity aspect.

Gold does not need you to study or train yourself for it: Investing in gold does not require any sort of special knowledge or wisdom or formal education to be attained on the part of the buyer. The buyer of gold does not have to put in any sort of portfolio management wisdom in action to acquire and hold gold. Also, the purchase and sale of gold is simple and straightforward. Gold is not complex financial instrument that need any special skills, training, or equipment to buy and recognize gold

Gold is for the long term : However, investment in gold is not a short term investment. It is a long term investment. If you want to make gold work out some good returns, then the holding period for gold must be long term. The storage cost of gold can be storage locker fees or safety deposit box rentals.

Gold’s unique position in the financial world offers a compelling case for its inclusion in a well diversified portfolio. Its ability to hedge against inflation, diversity portfolio, and provide stability during market volatility makes it a valuable asset. While not without considerations, gold’s enduring allure as a safe haven and a store of value continues to hold weight in the age of modern finance.

I